Nigeria's case against Binance draws close to turning point

The crypto exchange faces allegations of money laundering and tax evasion

The brawl between Nigerian authorities and Binance, the world’s largest crypto exchange, is on a close road. The saga started as an allegation bout and spiraled into a high-profile case with far-reaching consequences for the local crypto industry and international business relations.

On February 26, 2024, Tigran Gambaryan, Binance's head of financial crime compliance and a U.S. citizen, was detained by Nigerian authorities on charges of money laundering and tax evasion.

Nadeem Anjarwalla, the company’s regional manager for Africa, faced similar charges. He managed to flee confinement before the trial commenced.

Though discharged from the Federal Inland Revenue Service (FIRS) tax evasion case against the platform, Gambaryan has spent 6 months in detention, during which time his health has reportedly deteriorated.

The hearing by the Federal High Court, originally set for October 11, has now been rescheduled to September 2 at the request of defense lawyers. An earlier date signals urgency in resolving the case.

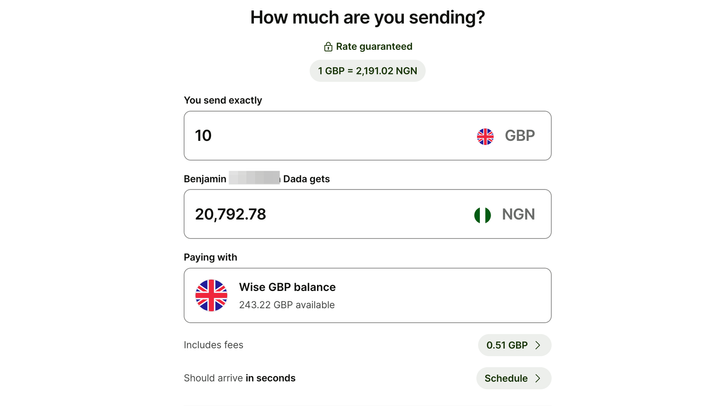

Authorities justify the case as a matter of national security, arguing that Binance’s operations contribute to the country’s ongoing currency crisis. The Naira plummeted to record lows, and crypto trading platforms were blamed for a black market for FX. Binance, on its part, denied the charges, insisting it complies with local regulations.

Gambaryan's captivity bothers family and international observers. In a statement released through Mondo-Advisory yesterday, his family detailed a health decline, claiming he is now bedridden, unable to walk due to a herniated disc. He has been denied medical care and access to his legal team. The U.S. Embassy in Nigeria has reportedly lost access to him.

“From July 26th to August 14th his lawyers were not allowed to visit him and prepare for his trial. They were allowed a brief 5-minute visit on August 15th but have since been blocked again. His legal team is, as such, unable to prepare him for trial, which goes against the Nigerian constitution,” the statement read.

His spouse, Yuki, has made quite the plea for his release. In a video accompanying the plea, she called on Nigerian and U.S. governments, and the international community, to intervene before it is too late. The ordeal has been compounded by Tigran missing personal milestones, like his son's fifth birthday and his [own] 40th birthday, while in custody, she said.

The case against Binance and its executives has broader implications beyond the struggles of those involved. Nigeria’s actions reflect a growing tension between governments and digital asset exchanges, as nations grapple with the challenges posed by digital currencies.

At the heart of this case is a question about the role of cryptocurrencies in modern economies. As they become more popular, they pose threats to traditional financial systems, especially in countries like Nigeria where the national currency is struggling.

Efforts to hold Binance accountable are an attempt to regain control over its monetary policy and protect its financial stability. But the methods employed—detaining foreign nationals and pushing for accelerated trials—have raised ethical concerns. It set a troubling precedent for international business operations in the nation and beyond.

As the September 2 trial date approaches, all eyes will be on the Nigerian system. The outcome of this case could have lasting effects on the relationship between crypto exchanges and governments, particularly in emerging markets.

The resolution will likely have implications for Binance and its execs and the future of crypto regulation. The balance between innovation and regulation is delicate worldwide, and the outcome in Nigeria could tip the scales in one direction or the other, shaping the future of digital currencies in ways difficult to predict.