Starlink is at the center of an ongoing spectacle in Kenya's internet space

Its unlikely works are worrisome for operators; a top telco wants authorities to look into the situation

The presence of Elon Musk's Starlink in Kenya’s internet landscape is bringing controversy. Safaricom, the country's largest provider, is worried over its licensing and operational model. The core concerns are the potential regulatory and security risks posed by granting independent licenses to satellite internet providers like Starlink, which operate without a physical presence.

“This [proxy] would mean negligible control for the government to ensure accountability for non-compliance issues”, the telco memoed. “Satellite coverage inherently spans multiple territorial borders and in doing so has the potential to illegally provide services and cause harmful interference within the territorial borders of the Republic of Kenya”, Safaricom warned.

The company proposed the industry watchdog mandate them to “only operate in Kenya subject to such providers establishing an agreement with an existing local licensee”. This way, they will be treated as infrastructure providers, with existing license holders—like Safaricom—handling the services.

In response, the Communications Authority of Kenya (CA), responsible for regulating telecoms and ICT services, recognized Safaricom’s concerns. The CA said “Any licensed service provider is entitled to raise regulatory issues, which the Authority would evaluate within its established mandate".

Safaricom's stance is clear: satellite internet providers should be required to partner with local MNOs, rather than operating independently. This, it argues, would mitigate risks and promote innovation. Aligning satellite operators with existing local licensees, Safaricom reckons the government would maintain greater control over compliance and service delivery.

This viewpoint came amid Starlink’s growing footprint since its market entry in July 2023. The satellite provider, backed by SpaceX, offers high-speed internet with broad coverage, particularly in remote areas where traditional ISPs have limited reach. During the launch, it had only 405 subscribers, but 2 months on, users more than tripled to 1,360. As of March 2024, the number had grown to over 4,850.

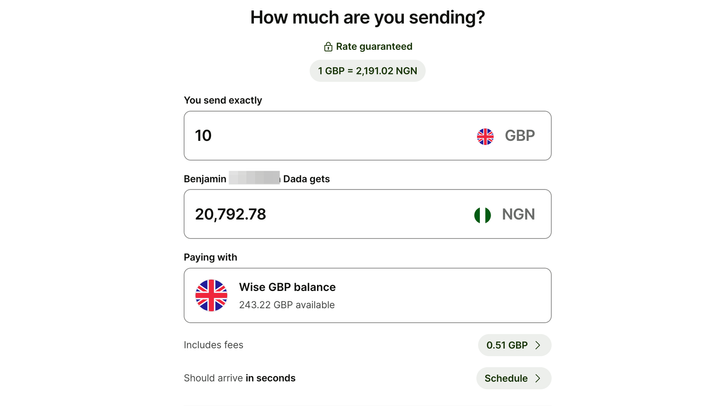

Less than a year after going live, Starlink went competitive with pricing, dropping its kit costs by 34%. Topping that, it last week rolled out a rental option quite cheaper than its outright purchase costs. Users can get a kit for $15 monthly, with a one-time hardware activation fee of $21. This bonus however does not affect internet bundle subscriptions.

This is troubling for local ISPs. As satellite internet becomes more accessible and affordable, legacy providers risk being outpaced on their turf. This is not unique to Kenya; other African countries have had similar fears. In Ghana, the National Communications Authority (NCA) declared Starlink's ops illegal, citing incomplete licensing. The same concerns were raised by regulators in Senegal, South Africa, Zimbabwe, and Cameroon, where no licensing bred pushbacks.

The spectacle gained further attention when a user on X claimed Safaricom had cancelled the payment option for Starlink on its mobile money service, M-PESA. Safaricom said the claim "isn't factual", confirming the payment option is still available and urging users to reach out if they encounter challenges.

In response to concerns, the Kenyan regulator has yet to commit to a formal consultation. However, it has indicated that it is investigating the issues raised as part of its regular practices. Its outcome could set a precedent for how satellite internet services will be regulated in the country.

Safaricom's stance is however not without other interests. Vodacom being its parent company, it has ties to SpaceMobile, a satellite communications firm billing itself as a direct Starlink competitor.

Vodafone was an early investor in SpaceMobile and has exclusive rights to its services in 24 countries across Africa and Europe. While it has yet to launch commercially, the Safaricom connection suggests the push for changes could be as much about protecting its market share as it is about addressing genuine security concerns.

As the CA weighs in, broader implications for the sector hang in the balance. In the coming months, how Kenya, with a reputation for inclusion, addresses the situation will be closely watched, not just within the country, but across the region, possibly influencing how elsewhere in Africa approach satellite internet integration.