BD Insider: A big win for crypto in Nigeria

In this letter, we explore; Nigeria’s SEC grants crypto licence to Quidax and Busha, Nvidia is struggling to impress its investors, Starlink records another win in Africa despite controversy in Kenya.

In this letter, we explore:

- Nigeria’s SEC grants crypto licence to Quidax and Busha

- Nvidia is struggling to impress its investors

- Starlink records another win in Africa despite controversy in Kenya

We also curated updates on startup funding in Africa, weekend reads, and several opportunities.

The big three!

Nigeria’s SEC grants crypto licence to Quidax and Busha

Nigeria’s been trying to figure out this whole crypto regulation thing. Last week, the country’s Securities and Exchange Commission (SEC) promised to issue its first crypto licences in August—and now they’ve delivered. Quidax and Busha, two major crypto exchanges, have officially been approved to operate legally in the country.

The licences were awarded under the Accelerated Regulatory Incubation Program (ARIP), a framework designed to onboard crypto firms that were operational before the SEC introduced specific regulations for virtual asset service providers.

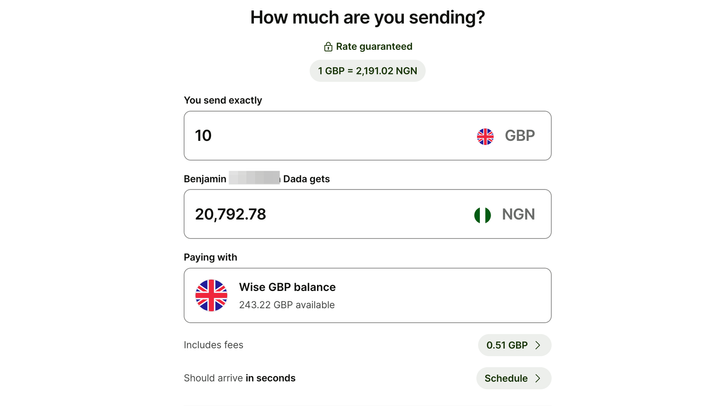

Context: This development comes after a period of regulatory uncertainty and challenges for crypto exchanges in Nigeria. The Central Bank of Nigeria (CBN) had previously imposed a ban on financial institutions facilitating crypto transactions. The Nigerian government accused crypto traders of using P2P trading to manipulate the naira.

In January, reports surfaced that at least two crypto exchanges were in discussions with the SEC about obtaining a crypto licence following the CBN's decision to lift a two-year ban on crypto-related banking transactions. But, by May 2024, the SEC's director general had instructed crypto exchanges to remove the naira from P2P trading.

Zoom out: For crypto services to be fully integrated into Nigeria’s financial system, the SEC and CBN will need to align their crypto regulation policies.

Nvidia struggling to impress its investors

As you climb higher, the pressure to perform often increases, and Nvidia is feeling the heat. The world's most valuable company appears to be grappling with the weight of its own success. Shares of the chip maker dropped 6% on Thursday after its forecast fell short of expectations.

While Nvidia's revenue and gross margin forecast for the current quarter were not far from analysts' estimates, the company's inability to outperform Wall Street's targets overshadowed its strong second-quarter results and the announcement of a $50 billion share buyback.

Zoom In: In the last three consecutive quarters, Nvidia recorded revenue growth of more than 200% and it looks like the company’s capacity to surpass expectations is prompting Wall Street to raise its targets even higher.

CEO Jensen Huang emphasised the insatiable demand for Nvidia's powerful graphics processors, which are essential for driving generative AI technologies like ChatGPT. However, concerns about production delays for the next-generation Blackwell chips and the potential for slower returns on AI investments dampened investor enthusiasm.

Zoom Out: The decline in Nvidia's stock price has raised broader questions about the future of the AI boom. Some investors fear that tech giants may reconsider their massive investments in data centres and AI infrastructure if the returns on these investments prove to be slower than anticipated.

Nvidia's biggest customers, including Microsoft, Alphabet, Amazon, and Meta Platforms, are expected to spend over $200 billion combined on AI infrastructure in 2024. The company's performance could serve as a barometer for the overall health of the AI industry and the potential for significant returns on these investments.

Starlink records another win in Africa despite controversy in Kenya

Starlink has seen this situation unfold before in Africa: while facing challenges in one country, they find success in another. It’s happening again now. After a year of regulatory struggles, Starlink is now available in Botswana.

The launch comes three months after the internet service provider obtained its operating licence from the Botswana Communications Regulatory Authority (BOCRA). The company first applied for the licence in early 2023, but BOCRA rejected the application in February 2024, resulting in a ban on the use, sale, and importation of Starlink kits in the country.

Meanwhile, in Kenya, Starlink appears to have unsettled Safaricom, the country’s leading telecom provider. On Wednesday, we discussed how Safaricom asked the Communications Authority (CA) to block satellite internet providers operating in other countries.

That same day, Safaricom had to deny allegations that it had restricted payments for Starlink services through its mobile money platform, M-PESA. The clarification was made on X after a user claimed the telco had cancelled payments to Starlink via M-PESA.

Context: In July 2023, Safaricom announced plans to collaborate with AST SpaceMobile to launch a satellite internet service to rival Starlink after it had to lower its internet pricing to win back customers who had switched to Starlink.

As the demand for high-speed internet connectivity continues to grow in Africa, the regulatory framework for satellite internet services will play a crucial role in determining the future of this technology in the region.

💰 State of Funding in Africa

Here’s a roundup of African startups that secured funding last week:

- Rwanda-based e-mobility startup Ampersand has secured $2 million in new equity investments from AHL Venture Partners and Everstrong Capital and reinvestment from Beyond Capital Ventures.

- South African AI & Data-analytics start-up, Omnisient has raised $7.5 million in Series A from Arise.

- Kenyan social commerce startup Sukhiba has secured $1.5 million in a seed extension round led by EQ2 Ventures. Other investors, such as Accion Venture Lab, Musha Ventures, Quona Capital, and existing investor CRE Ventures, participated in the round.

🍿 Weekend binge

- Why Africa’s largest city is a terrible place to live

- These were Nigeria’s 100 brightest teenagers in 2009. Where are they now?

- How this product manager deals with imposter syndrome

💼 Opportunities

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Enyata — Product Designer, Lagos

Data & Engineering

- Enyata — Backend Engineer, Lagos

Admin & Growth

- SoDigify — Marketing Manager, Remote