BD Insider 231: Apple's supply chain under scrutiny by Congo

Inside: We examine Nigeria's second payment gateway and crackdown on crypto traders. Additionally, we covered the latest on Starlink operations in Ghana.

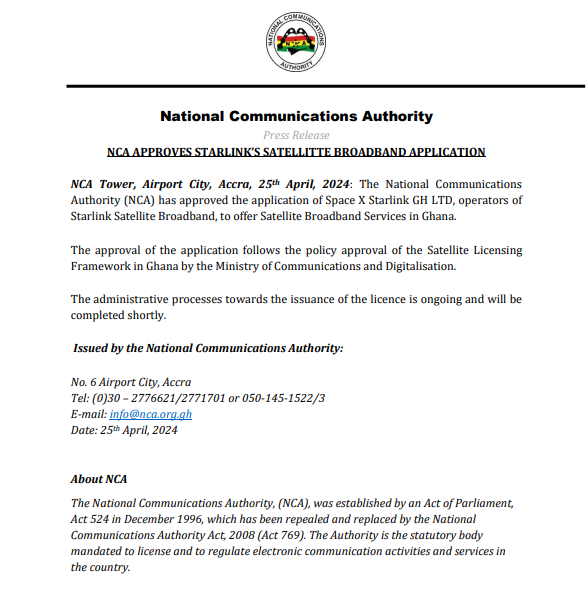

In a turn of events, Ghana's National Communication Authority (NCA) has approved Starlink's application to offer broadband services in the country. This comes just four months after the NCA initially banned Starlink, deeming it illegal.

In this letter, we examine:

- the second payment gateway in Nigeria

- Nigeria's continued crackdown on crypto traders

- Apple's Supply Chain Scrutiny in Congo

We also curated updates on the state of funding in Africa, other noteworthy information and several opportunities.

The big three!

#1. CBN approves Unified Payments as second gateway

The news: The Central Bank of Nigeria (CBN) has approved Unified Payments, a fintech company owned by a consortium of leading Nigerian banks, as a licensed Payment Terminal Service Aggregator (PTSA). This move aims to strengthen the enforcement of existing regulations requiring all point-of-sale (POS) transactions in Nigeria to be processed through a licensed PTSA.

Why it matters: In 2011, the CBN established a centralised system for POS transactions. The Nigeria Inter-Bank Settlement System Plc (NIBSS) was the sole authorised player, acting as the PTSA and operating the only Terminal Management System (TMS). This meant all POS terminals in the country had to connect through NIBSS.

However, the CBN is shaking things up with the recent approval of Unified Payments as a second PTSA. This move signals a break from the single-operator model, giving payment service providers the flexibility to route transactions through either Unified Payments or the existing NIBSS.

Know more: In a significant shift from past practices, the new CBN leadership opted for "transparency" in awarding the second PTSA licence. The bank implemented a public bidding process, a first for licensing payment service providers in Nigeria. This process was outlined in national newspapers on January 5, 2024, according to local media publication BusinessDay.

Following an evaluation, Unified Payments emerged as the frontrunner and was ultimately awarded the licence.

#2. Nigeria clamps down on crypto traders' bank accounts

The news: In a crackdown on suspected financial crimes, Nigeria's Economic and Financial Crimes Commission has frozen over 1,146 bank accounts linked to money laundering and terrorism financing (as per an ongoing investigation).

TechCabal reported that some affected users were informed their accounts were frozen due to suspected crypto trading. This crackdown follows accusations by the Nigerian government that peer-to-peer (P2P) crypto trading is being used for currency manipulation.

"We discovered that there are people in the system who are even doing worse than Binance. They called them P2P and all of that. We noticed in the last two days ago that dollars have started appreciating...then the naira was devalued again," said Ola Olukoyede, the EFCC chairman. "It was due to the activities of some of these guys on P2P platforms. I asked them to freeze [some] accounts. We found that one of [the account owners] had traded over $15 billion last year."

Know more: In March, tensions flared between Nigeria and cryptocurrency exchanges. The Central Bank of Nigeria (CBN) blocked access to major platforms like Binance, Kraken, and Coinbase. They also arrested Binance executives. Following these actions, the CBN demanded data on Binance's top 100 users in Nigeria, allegedly to track $26 billion in unidentified transactions. Binance has not yet provided this information.

This crackdown on crypto-linked accounts is seen by some as a way for the government to leverage bank data to track and disrupt financial crimes.

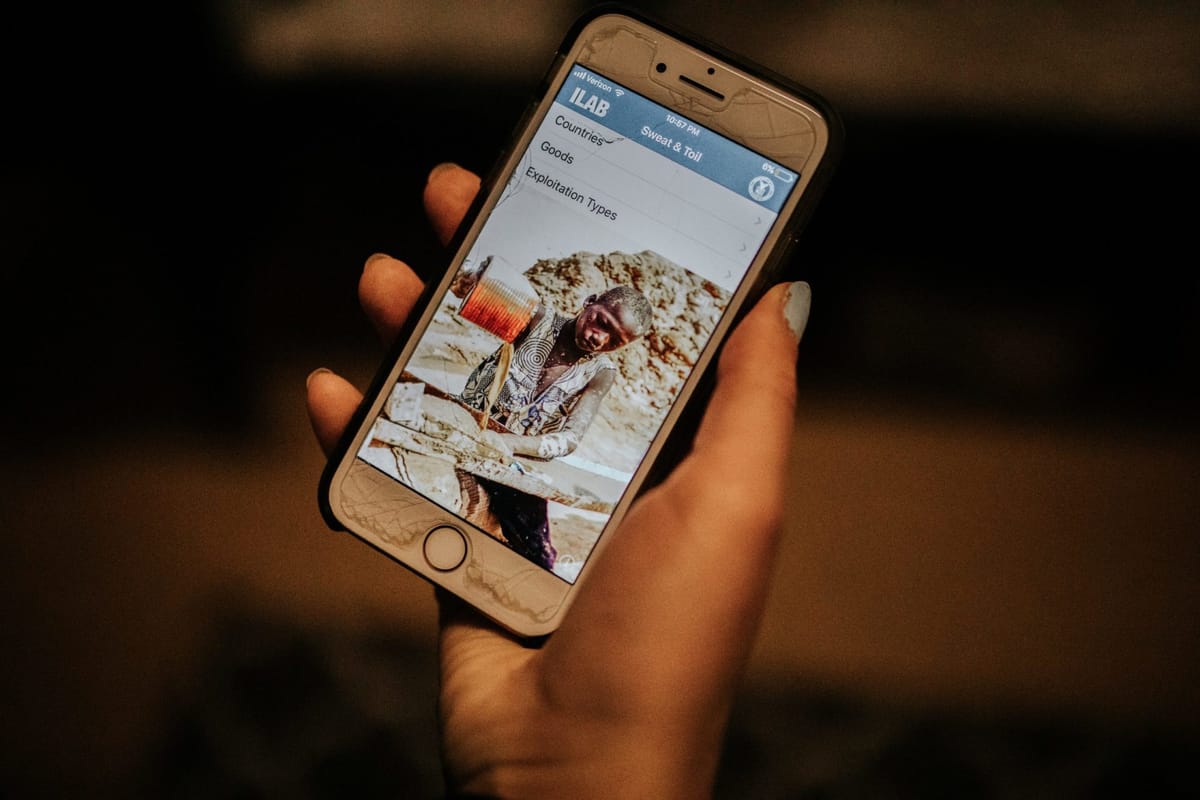

#3. Apple's supply chain under scrutiny by Congo

The news: The Democratic Republic of Congo (DRC) is raising concerns about Apple's supply chain, alleging its products could contain "blood minerals" mined in the war-torn eastern region.

- Lawyers representing the DRC sent a letter to Apple CEO Tim Cook on April 22, 2024, demanding answers within three weeks on the potential use of minerals linked to violence and human rights abuses.

- The lawyers, led by Robert Amsterdam, also released a report titled "Blood Minerals" criticising the tech industry's reliance on minerals sourced from a conflict zone.

- Amsterdam claims Apple's self-reported verification processes lack transparency, highlighting the discrepancy between Rwanda's minimal mineral production and its role in supplying major tech companies.

Context: The DRC has long been plagued by violence fueled by the illegal trade of minerals like 3TG. These minerals are used for electronics production, and armed groups often control their extraction, leading to human rights abuses and child labour.

"Although Apple has affirmed that it verifies the origins of minerals it uses to manufacture its products, those claims do not appear to be based on concrete, verifiable evidence," said Robert Amsterdam, founding partner of Amsterdam & Partners LLP. "The world’s eyes are wide shut: Rwanda’s production of key 3T minerals is near zero, and yet big tech companies say their minerals are sourced in Rwanda."

Apple, however, maintains its commitment to conflict-free materials in its latest report to the Security and Exchange Commission. The report claims they severed ties with 14 suppliers in 2023 who didn't meet their responsible sourcing standards.

Why it matters: This accusation puts pressure on Apple to strengthen its supply chain ethics. The DRC's claims, if proven true, could damage Apple's reputation and lead to legal action.

What's next: Apple has not yet responded to the DRC's inquiries.

💰 State of Funding in Africa

- Last week, TLcom Capital raised a $154 million fund to invest in early-stage startups, extending its reach beyond Sub-Saharan Africa to Egypt.

- NBA Africa, a subsidiary of the National Basketball Association also launched "Triple Double", an accelerator programme, to invest in early-stage African startups. Only 10 startups will be chosen to form the inaugural cohort.

Meanwhile, Egypt led the way in VC funding for African tech startups last week, here's the breakdown:

- Bokra, an Egyptian fintech startup closed a $4.6 million pre-seed round led by DisrupTech Ventures and SS Capital, among other investors.

- Egypt-based HRTech bluworks raised a $1 million pre-seed from Khawarizmi Ventures, Camel Ventures, Acasia Ventures and other angel investors.

- Potcast, an Egyptian fintech startup raised an early financing round at an undisclosed value, through the Shark Tank programme.

- Another Egypt-based Fintech, Waffarha secured a seven-figure seed round led by Value Makers Studio (VMS).

- Outside Egypt, HyperionDev a South African edtech raised approximately $5 million from 23 undisclosed funders.

📚 Noteworthy

Here are other important stories in the media:

- Amenawon Esezobor’s remarkable journey to becoming a world-class software engineer: In this interview, our managing editor Daniel Adeyemi delved into Esezobor's early inspirations, the surprising twist that led her away from a medical career and towards software engineering, and what excites her most about the future.

- X, social media’s paradoxical bastion of authentic information: As X evolves into its new phase under Elon Musk's leadership, it does so along the treacherous waters of content moderation, Andrew Christian writes.

- Crypto regulation in South Africa: Last week, South Africa released a list of 75 licensed crypto asset service providers, but major players like Binance and Yellow Card are missing.

- Anchor launches On Deck to educate Africans on fintech: Building on its outstanding performance in 2023 – processing over $450 million transaction volume – Anchor believes educating the public about financial literacy remains paramount to ensuring continued growth and financial inclusion.

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Yassir — Graphic Designer, Algeria

- Kuda — Senior Product Manager, Lagos

- PayU — Product Managerin, Lagos

Data & Engineering

- Chowdeck — Senior Backend Engineer, Lagos

- PalmPay — Software Engineer, Lagos

- ETAP — Senior Fullstack Engineer, Lagos

Admin & Growth

- Heirs Insurance — Marketing and Sales Executives, Lagos

- Chowdeck — Social Media Intern, Lagos

- Yassir — Digital Marketing Manager, Johannesburg

Other opportunities

- Call for delegates: Ahead of the Journalism, Digital Tech and AI Dialogue next month, the Centre for Journalism Innovation and Development is inviting journalists interested in digital technology and artificial intelligence to apply by May 6, to participate in the event.

- For African early-stage startups: Applications for Pitch2Win are now open. The winner gets $10,000 equity-free prize money and an opportunity to attend the IVS Event in Kyoto Japan. Deadline: May 5, 2024.

- For African tech entreprenuers: The FC Startup Innovation Challenge offers African tech entreprenuers a chance to win a $1,000 equity-free cash prize plus up to $300,000 worth of incredible perks from Paystack, Google for Startups, Intercom, AWS and Founders Factory to fuel your startup's growth. Apply by April 28.

Thanks for reading this edition.

Have a great week!

Comments ()